Non-Recourse CMBS Loans for Commerical Properties

If you’re looking for flexible, non-recourse, fixed-rate financing for your multifamily or commercial property, a CMBS loan could be the perfect fit. Fortunately, the CMBS financing experts are CMBSLoans.us are ready and waiting to help you get the financing you deserve.

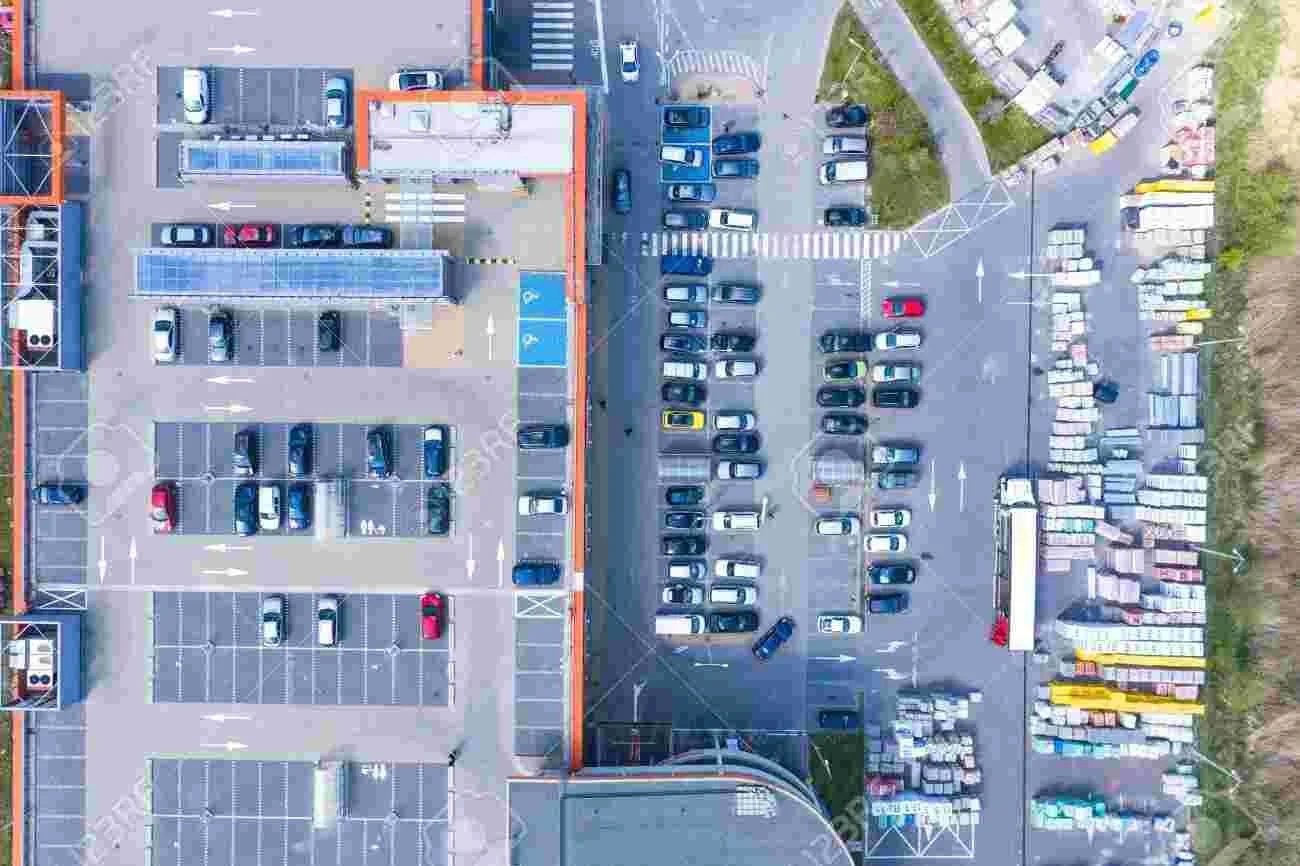

CMBS loans, also referred to as conduit loans, are available for nearly all income-producing property types, including multifamily apartments, industrial properties, senior living, retail, office, and hotels, as well as unique property types like parking lots, marinas, or even recreational facilities.

CMBS loans are generally issued in either 5, 7, or 10-year fixed-rate terms. Financing is non-recourse with standard bad-boy carve-outs for fraud and intentional bankruptcy, which means that, unless you break the rules, the borrower cannot attempt to repossess your personal property to pay back the loan.

Terms and Requirements for CMBS Loans

Unlike bank loans or life insurance company loans for commercial properties, or Fannie Mae, Freddie Mac, and HUD multifamily financing for apartment properties, CMBS loans have relatively lenient borrower requirements.

CMBS terms and requirements include:

LTV: Up 75%-80%

DSCR: Minimum DSCR of 1.25x, more for riskier property types.

Net Worth: Borrower net worth of 25% of the entire loan amount.

Liquidity: Liquidity of 10% of the entire loan amount.

Credit Score: A credit score of 600+

In some situations, CMBS lenders may overlook borrower credit or legal issues if the property is performing exceptionally well. These requirements are in stark contrast to the loan types mentioned above, which often require a borrower to have a net worth of 100% of the loan amount, 25% liquidity, and credit scores of 660-680+.

Don’t Pay An Expensive CMBS Loan Broker

In the world of CMBS, some brokers and advisors charge exorbitant fees, and those fees come out of your pocket, not the lenders.

Our expert advisory partners take only a small fee, typically 0.75% or less, and only get charged if a loan closes. Our advisors are not lenders and are not tied to any one shop. This means they will get different lenders bidding on the same loan with one goal; to get you the lowest rates, highest leverage, and best terms available.

Increase Leverage With Mezzanine Debt and Preferred Equity

If your CMBS lender is only willing to lend up to 65% on your asset, but you want or need additional leverage, this can sometimes be achieved with an additional mezzanine loan or preferred equity via an intercreditor agreement, sometimes referred to as a subordination agreement. This can be particularly beneficial if you are purchasing a property with existing CMBS financing and assuming a loan from the previous property owner. Often, this can boost your overall LTV up to 75-80%.

CMBS Retail Property Loans

CMBS Multifamily Loans

As the largest and perhaps least risky commercial real estate asset class, CMBS lenders are often willing to fund multifamily and apartment properties with particularly generous terms. Leverage ranges up to 80% LTV, while DSCRs can go as low as 1.25x. Mixed-use properties, senior living, student housing, affordable housing and other property type variations are also allowed.

CMBS loans have emerged as one of the best methods to finance retail properties and shopping centers across the United States. As with most lenders, conduit lenders prefer properties with strong anchor tenants, as well as properties with triple-net (NNN) leases. Leverage ranges up to 75% LTV with minimum DSCRs of 1.25-1.35x. Mixed-use properties are also generally eligible for CMBS financing.

CMBS Student Housing Loans

CMBS Senior Housing and Assisted Living Loans

CMBS Office Property Loans

CMBS Hotel Loans

CMBS Affordable Housing Loans

CMBS Self-Storage Property Loans

CMBS Mixed-Use Property Loans

CMBS Industrial Property Loans

CMBS Marina Loans

CMBS Mobile Home Park Loans

Get the Top Lenders Bidding On Your CMBS Loan

Our expert advisory partners work with a wide variety of lenders to get you the best terms and the lowest rates on your loan. These include:

Goldman Sachs - Citigroup - KeyBank - Bank of America - Rialto -Wells Fargo - UBS - Credit Suisse - Deutsche Bank - Natixis - Ladder - Cantor- Benefit - Starwood

CMBS Primer and Guides for Borrowers and Investors

We focus on providing information and advisory services, particularly for commercial real estate investors who want to finance their property using CMBS loans. However, we also provide in-depth insight into the industry for those interested in investing in CMBS, and even those who want to work in the industry.

Our in-depth guides cover all aspects of CMBS, from the mundane to the technical, including examining CMBS credit spreads, the CMBS origination process, CMBS legal structuring (including an in-depth dive into REMICs), CMBS pooling and servicing agreements, CMBS tranches, CMBS prepayment using defeasance or yield maintenance, CMBS syndication, as well as the roles of master servicers and special servicers in the CMBS lending process.